Car insurance in Australia serves as a financial safety net, safeguarding drivers against significant out-of-pocket expenses in the event of accidents, theft, or other unexpected events. It is not simply a precaution, but a legal necessity in many jurisdictions, ensuring that all drivers have a basic level of financial accountability. The importance of car insurance extends beyond legal compliance; it is essential in protecting both your assets and personal wellbeing.

There are primarily three types of car insurance available in Australia: Compulsory Third Party (CTP) insurance, Third Party Property insurance, and Comprehensive insurance. CTP insurance is mandatory and covers personal injury liability for drivers who injure someone in a car accident. On the other hand, Third Party Property insurance covers damage to other people’s vehicles and property, but not your own. Comprehensive insurance, as the name suggests, provides extensive coverage including damage to your own vehicle, and typically incorporates benefits of the other types.

Adequate coverage is paramount for all drivers. Accidents and unforeseen incidents can occur at any time, leaving individuals vulnerable to significant financial burdens. Without sufficient car insurance, a driver could be liable for high repair costs, medical bills, and other accident-related expenses, making it challenging to recover financially. Thus, understanding the different types of car insurance and selecting the right policy is crucial. Ensuring that your policy includes adequate coverage will provide peace of mind and substantial protection against the unforeseen.

The Types of Car Insurance Available

Car insurance in Australia is categorized into several types, each offering different levels of coverage to suit varying needs and circumstances. Understanding these types can help you make informed decisions about which insurance best fits your requirements. The primary types of car insurance available in Australia include Third-Party Property, Third-Party Fire and Theft, and Comprehensive Insurance, each serving distinct purposes.

Third-Party Property Insurance is the most basic form of car insurance. It covers damage you may cause to other people’s property with your vehicle. However, it does not cover any damage to your own car. This type of insurance is beneficial if your vehicle has low-market value and you primarily want protection against financial liability you may incur from damaging another person’s property.

Third-Party Fire and Theft Insurance adds another layer of protection to the basic third-party property coverage. In addition to covering damages to other people’s property, it also covers your vehicle if it is stolen or damaged by fire. This type of insurance is typically suitable for those who seek additional security without incurring the higher costs associated with comprehensive insurance, particularly if they live in areas prone to vehicle theft or have concerns regarding fire damage.

Comprehensive Insurance offers the broadest coverage among the three types. It encompasses third-party property damage, theft, fire, and also covers accidental damage to your own vehicle and sometimes personal belongings inside the car. This type of insurance is ideal for individuals who need extensive protection, especially those who own newer or high-value vehicles. It provides peace of mind by covering a variety of potential risks, from minor accidents to significant incidents.

Each type of car insurance in Australia serves different needs based on individual circumstances. Whether you are seeking basic protection, additional safeguards against theft and fire, or comprehensive coverage for utmost security, understanding these options allows you to choose the insurance that best fits your needs and offers the corresponding benefits.

Factors Affecting Car Insurance Premiums

Car insurance premiums in Australia are influenced by multiple variables, each playing a significant role in determining the cost of coverage. Understanding these factors is essential for consumers aiming to manage their insurance expenses effectively.

Firstly, the driver’s age is a crucial determinant. Insurance providers often classify younger drivers, particularly those under 25, as higher risk due to statistically higher accident rates among this age group. Consequently, premiums for younger drivers tend to be substantially higher. Conversely, more experienced drivers typically benefit from reduced premiums given their proven track record and risk assessment.

The driver’s driving history also significantly impacts insurance premiums. A clean driving record, free from accidents and traffic violations, signals to insurers that the driver is lower risk, leading to lower premiums. In contrast, a history of accidents or traffic infractions can considerably increase insurance costs, as insurers perceive these individuals as higher-risk clients.

Another factor is the type of vehicle being insured. High-performance cars, luxury vehicles, or those with costly repairs usually attract higher premiums. Such vehicles are not only more expensive to repair or replace but also present a higher theft risk. Conversely, vehicles with advanced safety features or lower replacement costs may be eligible for lower premiums.

Where the car is parked—whether on the street, in a private driveway, or within a secured garage—also affects insurance premiums. Vehicles parked in secure locations are less likely to be stolen or vandalized, leading to lower premium rates. Insurers often charge higher premiums for cars parked in areas with higher crime rates due to the increased risk of theft and damage.

Finally, the intended use of the vehicle, whether for personal use, commuting, or business purposes, also influences insurance costs. Vehicles used for business purposes are generally subject to higher premiums because they’re on the road more frequently, raising the risk of accidents.

By comprehensively understanding these factors, consumers can better navigate the complexities of car insurance in Australia, potentially reducing their premiums through informed decisions and proactive risk management.“`html

How to Choose the Right Car Insurance Policy

Selecting the most suitable car insurance policy is an essential decision that requires careful consideration of several factors. Given the array of options available in Australia, it is vital to compare policies effectively, understand insurance terminology, and consider specific elements such as coverage limits, excess amounts, and policy exclusions.

To begin with, when comparing car insurance policies, focus on the extent of coverage each policy offers. Comprehensive car insurance typically provides the broadest coverage, including protection against theft, accidents, and damage from natural disasters. However, policies such as Third-Party Fire and Theft or Third-Party Property Damage may suit those with older vehicles or limited budgets. Assess your needs and financial situation to select a policy that best aligns with your circumstances.

Understanding the terminology used in car insurance policies can also significantly affect your decision. Common terms include ‘premium,’ which is the amount you pay for coverage, and ‘excess,’ the amount you must contribute in the event of a claim. Familiarize yourself with terms like ‘no-claim bonus’ which rewards you for not making any claims, and ‘market value’ versus ‘agreed value’ when determining the payout amount for your vehicle.

Evaluate the coverage limits in each policy. This indicates the maximum amount an insurer will pay out for claims under specific circumstances. Higher coverage limits typically mean better protection but could also result in higher premiums. Analyze whether the coverage limit of a policy sufficiently meets your needs, especially if you have a high-value vehicle.

Another critical factor is the excess amount. Policies with lower excess amounts usually attract higher premiums, while higher excess options could lower your premium but increase your out-of-pocket expense when making a claim. Choose an excess level that balances affordability with your capacity to cover the excess if necessary.

Lastly, pay close attention to policy exclusions. These are situations or conditions not covered by the insurance policy. Common exclusions may include damage from wear and tear, incidents occurring when the driver is under the influence, or improper usage of the vehicle. Being aware of exclusions ensures there are no surprises when submitting a claim.

By considering these factors and understanding the nuances of different policies, you can make an informed decision and select a car insurance policy that provides optimal protection tailored to your needs.“`

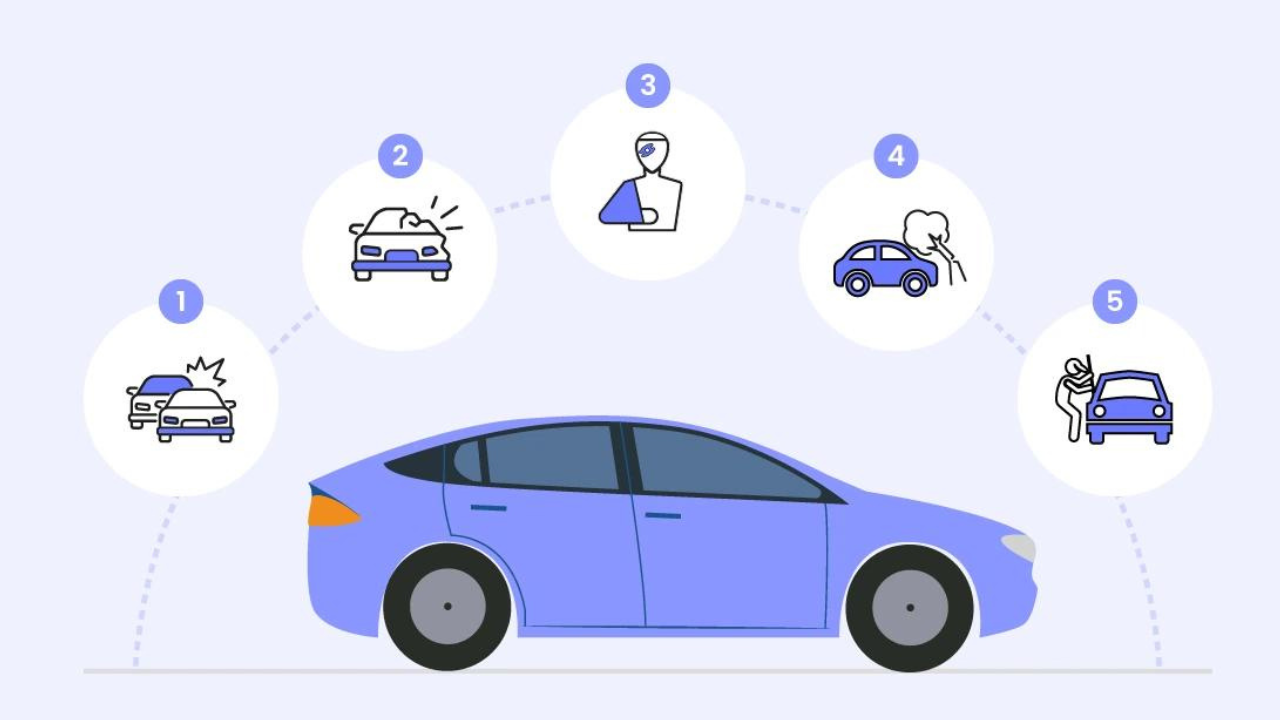

The Claims Process Explained

Understanding the car insurance claims process is paramount to ensuring a smooth resolution in case of an accident or theft in Australia. The process begins with promptly reporting the incident to your insurance company. This initial step is critical; most insurers have a specific timeframe within which a claim must be lodged, typically ranging from 24 to 48 hours post-incident. Immediate reporting helps expedite the investigation and approval process.

Once the incident is reported, the next step involves gathering all necessary documentation. This includes but is not limited to, a police report (especially in cases of theft or significant accidents), photographic evidence of the damages, witness statements, and details of the other party involved, if applicable. Effective documentation serves as the backbone of the claims process, ensuring that all aspects of the incident are accurately represented.

Following documentation, the insurer will assign a claims assessor to your case. The assessor’s role is to evaluate the damage and determine the extent of coverage as per your policy. This may involve a physical inspection of your vehicle or a review of submitted photographs. At this stage, transparency and honest communication with the assessor are essential to avoid any delays or complications.

After the assessment, the insurer will make a decision on the claim based on the assessor’s report and your policy coverage. If the claim is approved, you will be informed about the next steps. These typically involve selecting a repairer from the insurer’s authorized network to repair your vehicle or, in the case of total loss, initiating the process for replacement or cash settlement.

Throughout the claims process, maintaining clear and consistent communication with your insurance company can significantly enhance the experience. Knowing your policy details, understanding your rights, and being well-prepared can facilitate a streamlined and less stressful claims process. Ultimately, the goal is to restore your vehicle and peace of mind as quickly and efficiently as possible.

Common Mistakes to Avoid When Buying Car Insurance

When purchasing car insurance, consumers often fall into a few common traps that can lead to insufficient coverage and unanticipated expenses. It’s crucial to navigate the process with a clear understanding to avoid these frequent mistakes.

The first mistake many people make is underinsuring their vehicle. While it may be tempting to choose the minimum required coverage to save on premiums, this approach can lead to significant financial loss in the event of an accident. Comprehensive coverage, which includes protection for theft, weather damage, and other non-collision incidents, ensures that you are adequately protected. It’s important to assess the true value of your vehicle and potential repair costs to determine the appropriate level of coverage.

Another common error is failing to read the policy details thoroughly. Car insurance policies can include a range of specific conditions, exclusions, and limitations that may affect your coverage. Skimming through these details or neglecting to understand the fine print can result in unexpected surprises when it comes time to file a claim. Always take the time to review the contract and ask your insurance provider for clarification on any ambiguous terms.

Comparing multiple quotes is an essential step that many consumers overlook. Different insurance providers offer varying rates and incentives, and failing to shop around can mean missing out on more favorable terms. Take the time to gather and compare several quotes, considering not only the premium costs but also the extent of coverage, deductibles, and additional benefits offered by each policy. Online comparison tools can be a valuable resource in this process.

Lastly, not updating your policy when your circumstances change can also be a costly oversight. Significant life events like moving to a new location, adding another driver, or purchasing a new vehicle can impact your insurance needs and eligibility for discounts. Regularly reviewing and updating your policy ensures that you maintain appropriate coverage and take advantage of potential savings.

By avoiding these common pitfalls and being diligent in your approach, you can secure car insurance that provides comprehensive protection and peace of mind.“`html

The Role of Car Insurance in Financial Protection

Car insurance plays a pivotal role in safeguarding individuals from significant financial jeopardy. In the event of accidents, theft, or other unforeseen incidents, car insurance serves as a crucial financial safety net that helps policyholders manage the often exorbitant costs associated with vehicle repairs, replacements, or medical expenses. Without adequate coverage, the financial burden from these occurrences can be overwhelming, with damages not only affecting immediate costs but potentially leading to long-term economic strain.

The financial implications of not having car insurance can be severe. The absence of coverage in the case of an accident means the individual is responsible for all associated costs out-of-pocket. This includes vehicle repairs for both parties, legal fees, and potential medical expenses if injuries occur. These costs can quickly escalate, creating a financial strain that may be difficult to recover from, particularly in the case of a serious accident. Furthermore, for business owners or those who rely on their vehicle for their livelihood, a lack of insurance may result in severe business disruptions or loss of income.

Conversely, being adequately covered by car insurance provides peace of mind. Knowing that in the event of an incident there are measures in place to cover major expenses allows drivers to navigate their daily commutes and long-distance trips with greater confidence. Adequate insurance can also offer additional benefits such as coverage for rental vehicles, roadside assistance, and protection from uninsured motorists. These additional services further strengthen the safety net that car insurance provides, ensuring a comprehensive buffer against an array of potential financial pitfalls.

Thus, the role of car insurance extends beyond mere legal compliance; it represents a vital aspect of financial planning and risk management. By ensuring proper coverage, individuals protect themselves from substantial financial hardship and maintain a level of security that enhances overall peace of mind.“`

Future Trends in Car Insurance in Australia

As the car insurance landscape continuously evolves, several emerging trends are poised to redefine the future of car insurance in Australia. One significant development is the integration of telematics technology. This system leverages GPS and on-board diagnostics to monitor driving behaviors, including speed, braking, and mileage. Insurers can then use this data to tailor premiums more accurately, often rewarding safe drivers with lower rates.

Another transformative trend is the rise of usage-based insurance (UBI). UBI aligns premiums more closely with actual vehicle usage rather than adopting a one-size-fits-all approach. This type of coverage is especially beneficial for infrequent drivers who traditionally pay higher premiums based on assumptions of average usage. Telematics often plays a crucial role in UBI, ensuring detailed monitoring and fair pricing.

Autonomous vehicles, though still in the developmental stages, are set to dramatically impact the insurance market. As self-driving technology advances, the shift in liability from drivers to manufacturers could lead to new forms of insurance policies. Furthermore, the reduction in human error is likely to decrease accident rates, potentially lowering overall premium costs. However, the complexity of software-driven systems may introduce new risks that insurers will need to address.

Moreover, the increasing prevalence of electric vehicles (EVs) presents unique insurance considerations. EVs typically have higher repair costs due to specialized parts and technology. Insurers are adapting by offering specialized policies that account for these factors, ensuring that EV owners receive appropriate coverage.

As these trends gain momentum, consumers can expect more personalized, data-driven insurance products. The emphasis on real-time data and individual driving habits will likely enhance transparency and fairness in premium calculation. Furthermore, the shift towards UBI and telematics signifies a more flexible and responsive insurance market, catering to diverse needs and driving patterns.

In conclusion, the car insurance industry in Australia is on the cusp of significant transformation. Embracing these emerging trends will be essential for both insurers and consumers to navigate the changing landscape effectively.

Conclusion

Car insurance in Australia is essential for all vehicle owners, providing crucial financial protection against accidents, theft, and liability. With various types of coverage available—such as third-party, third-party fire and theft, and comprehensive insurance—drivers can choose a policy that best meets their individual needs and circumstances.

If you have any questions or concerns about our Article, please reach out to our support team. We’re here to help you!

Wonderful web site. Plenty of helpful info here. I am sending it to some friends ans additionally sharing in delicious. And naturally, thanks for your effort!