Car insurance serves as a crucial financial product that provides protection for vehicle owners in the United States. Its primary purpose is to mitigate the financial risks associated with owning and operating a motor vehicle. In an environment where accidents and unforeseen events can lead to significant expenses, car insurance acts as a safety net by covering damages arising from collisions, theft, vandalism, and other incidents. Understanding how this essential form of protection operates is vital for every driver.

At its core, car insurance operates on the principles of risk management and liability protection. Insurance companies assess various risk factors, including the driver’s history, the type of vehicle, and geographical location, to determine premium rates. This process ensures that individuals are charged fairly based on their likelihood of filing a claim. In essence, the concept of pooling resources comes into play, where the premiums collected from numerous policyholders contribute to the compensation paid out to those facing losses. This collaborative approach helps minimize the financial impact that a car accident can impose on a single individual.

Liability protection is another important aspect of car insurance. In the event of an accident where the driver is at fault, liability insurance can cover the cost of damages to other persons and their property. This feature not only safeguards the insured driver from potential lawsuits but also fulfills state-mandated requirements. Consequently, navigating the complexities of car insurance can be daunting, but understanding its fundamental components—risk management, liability coverage, and the role of premiums—is essential. This foundational knowledge sets the stage for exploring the various types, benefits, and considerations associated with car insurance in subsequent sections.

Types of Car Insurance Coverage

Understanding the various types of car insurance coverage is crucial for drivers in the United States. The primary forms of coverage include liability insurance, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection. Each type serves a specific purpose, and familiarity with these can help individuals select the right policy for their needs.

Liability insurance is one of the most fundamental requirements for car owners. It protects drivers against financial losses when they are responsible for causing damage to another vehicle or injury to another person. It typically comprises two components: bodily injury liability, which covers medical expenses for injured parties, and property damage liability, which covers repair costs for damaged properties. Each state establishes its minimum liability limits, ensuring drivers maintain adequate coverage.

Collision coverage, while not mandatory, is a popular addition to many car insurance policies. This type of coverage helps pay for damage to your vehicle resulting from a collision with another vehicle or an object, regardless of fault. This can be particularly beneficial for those with newer or high-value vehicles, as it mitigates the financial burden associated with repairs or replacements.

Comprehensive coverage is another essential aspect of car insurance. Unlike collision coverage, comprehensive insurance addresses damages resulting from events other than collisions, such as theft, vandalism, natural disasters, or collisions with animals. This protection ensures that drivers are safeguarded against various unforeseen circumstances that could lead to significant financial loss.

Uninsured and underinsured motorist coverage is designed to protect drivers if they are involved in an accident with someone who lacks sufficient insurance. This type of coverage helps cover medical expenses and damages when an at-fault driver has little or no insurance, ensuring that victims are not left with overwhelming costs. Finally, personal injury protection (PIP) provides coverage for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault in an accident. Together, these forms of coverage create a robust safety net for drivers navigating the complexities of the roadways.

State-Specific Insurance Requirements

Car insurance requirements can vary significantly across the United States, with each state implementing its own regulations and minimum coverage mandates. Understanding these state-specific insurance requirements is crucial for car owners, as it ensures compliance with local laws and protection against potential legal liabilities. Each jurisdiction determines the types of coverage that must be included in a car insurance policy, as well as the minimum limits that must be adhered to by motorists.

For instance, some states, like New York and New Jersey, have no-fault laws, which mandate that drivers carry personal injury protection (PIP) insurance. This coverage pays for medical expenses and related costs regardless of who is at fault in an accident. Conversely, states such as Texas and Virginia operate on a tort system, requiring liability insurance that covers bodily injury and property damage, with specific minimum limits that must be maintained.

The variance also extends to uninsured and underinsured motorist coverage. In states like California, this type of coverage is mandatory, wherein drivers can file claims if they are involved in accidents with drivers who lack adequate insurance. Other states may recommend this coverage but do not require it, potentially leaving drivers vulnerable to substantial financial losses.

Furthermore, some states, like Illinois and Massachusetts, have specific requirements concerning the amounts of liability coverage that must be purchased. Typically, these minimums are established to protect both the driver and other parties involved in an accident. It is vital for car owners to familiarize themselves with their state’s regulations, as non-compliance could result in fines, penalties, or even the suspension of driving privileges.

In conclusion, due diligence regarding state-specific insurance requirements is essential for car owners throughout the United States. By comprehensively understanding these regulations, drivers can ensure they have the necessary protection while abiding by the law.

Understanding Premiums and Deductibles

Car insurance premiums and deductibles are fundamental components of any auto insurance policy. A premium is the amount that a policyholder pays, typically on an annual or semi-annual basis, to maintain their coverage. Factors influencing the calculation of premiums include driving history, the type of vehicle, geographical location, age, and credit score. For instance, drivers with a clean driving record generally enjoy lower premiums, as are vehicles with advanced safety features. On the other hand, a history of accidents or a high-performance car can lead to increased costs. Additionally, where the vehicle is primarily parked can significantly influence the premium rates, with urban areas often commanding higher premiums due to increased risk of theft or accidents.

Deductibles, in contrast, are the amounts a policyholder is required to pay out-of-pocket before the insurance coverage kicks in following a claim. A higher deductible typically leads to a lower premium, since the policyholder is assuming more risk. Choosing an appropriate deductible amount is crucial and should be based on individual financial circumstances and risk tolerance. For example, a person with substantial savings may opt for a higher deductible, reducing their premium and overall insurance expense. In contrast, someone with limited economic resources may prefer a lower deductible, ensuring minimal out-of-pocket costs in the event of an accident.

Understanding the balance between premiums and deductibles helps policyholders make informed decisions regarding their auto insurance. By analyzing personal driving habits, vehicle type, and local conditions, individuals can effectively customize their policy to suit their needs while managing costs effectively.

How to Choose the Right Car Insurance Policy

Selecting the right car insurance policy is critical for protecting both personal assets and financial stability. Begin by assessing your individual needs, considering factors such as your driving habits, the value of your vehicle, and your budget for insurance premiums. Understanding your specific requirements will help in determining the necessary level of coverage. For instance, if you drive frequently or own a new car, comprehensive coverage may be essential. Conversely, if you have an older vehicle, a more basic policy might suffice.

Once you have a sense of your requirements, it is prudent to obtain and compare quotes from multiple insurance providers. Online comparison tools can be particularly beneficial as they allow you to evaluate various policies side by side. While comparing quotes, pay attention not only to the premium costs but also to the coverage limits and deductibles. A lower premium might seem attractive, but if it comes with higher deductibles or insufficient coverage, it might not be the best choice in the long run.

Understanding the details of each policy is equally important. Familiarize yourself with the different types of coverage available, such as liability, collision, and uninsured motorist coverage. Each type serves a specific purpose, and it is crucial to ensure that you have adequate protection against potential risks. Additionally, examining the exclusions within the policy documents can help prevent future misunderstanding regarding what is covered and what is not.

Finally, reviewing your coverage regularly can ensure it aligns with any changes in your personal circumstances, such as relocating, purchasing a new vehicle, or experiencing changes in financial status. By taking these steps, you can make informed decisions and select a car insurance policy that best fits your needs.

Discounts and Savings on Car Insurance

Car insurance can be a significant expense for many drivers in the United States. However, understanding the various discounts available can lead to substantial savings on insurance premiums. Insurance companies often provide different incentives to attract and retain customers, making it easier for drivers to find ways to lower their costs. This section explores the most common discounts accessible to policyholders.

One of the primary forms of discounts is for safe driving. Many insurers offer reductions for drivers who maintain a clean driving record, meaning no accidents or traffic violations over a specified period. This safety discount reflects the insurer’s lower risk when insuring a responsible driver. Additionally, some companies also offer discounts for completing defensive driving courses, further emphasizing safe behavior behind the wheel.

Bundling policies is another effective way to save money. Many insurance companies provide discounts to customers who combine their car insurance with other types of coverage, such as homeowners or renters insurance. This not only simplifies the management of multiple policies but can lead to a notable decrease in overall expenses.

Young drivers and students may also take advantage of good student discounts. Many insurers reward academic achievement by offering lower rates to students with a GPA above a certain threshold. This policy encourages safe driving habits among young, inexperienced drivers, reducing overall risk for insurers.

Furthermore, some companies extend discounts for vehicle safety features. Cars equipped with advanced safety technology, such as anti-lock brakes, airbags, and anti-theft devices often qualify for these reductions, providing an incentive for drivers to choose safer vehicles.

In addition to these common discounts, individual insurers may offer additional savings opportunities, so it is advisable for policyholders to actively inquire about available discounts when purchasing or renewing their car insurance. These various savings options make it feasible for drivers to reduce their insurance expenses while maintaining essential coverage.

Handling Claims and Customer Service

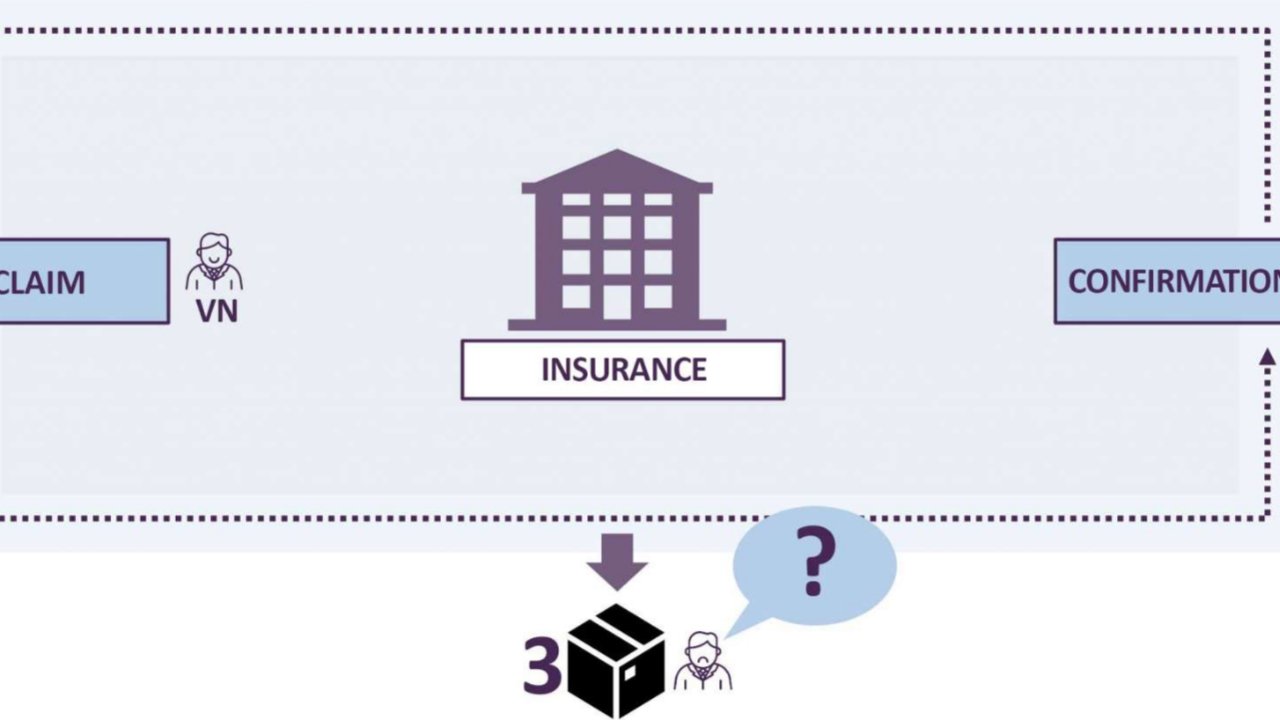

When it comes to managing car insurance, understanding how to effectively handle claims and navigate customer service is crucial. The process of filing a claim can appear daunting, yet it can be made simpler with organized steps and thorough documentation. Immediately after an incident, the policyholder should ensure that all relevant details are recorded, including taking photographs of the damage, collecting witness statements, and gathering police reports if applicable. This documentation serves as essential evidence that supports the claim.

After the initial documentation, the next step involves contacting the car insurance provider to report the incident. The insurer will guide the policyholder through the claims process, which typically includes completing a claim form and providing the previously collected evidence. During this phase, policyholders should remain clear and concise in their communication and ensure they understand all terms associated with their claim.

The role of the insurance adjuster becomes significant at this point. Insurance adjusters are responsible for assessing the damage and determining the cost of repairs or replacements. They will review the submitted documentation and might conduct an inspection of the vehicle to evaluate the extent of the damages. It is important for policyholders to maintain open lines of communication with the adjuster, as they can provide clarity on the claims process and answer any lingering questions.

Additionally, navigating customer service can often be challenging. When reaching out to an insurance company, it is beneficial to have necessary information on hand, including policy numbers and claim reference numbers. Using these details allows representatives to assist more effectively. If issues arise, documentation of all interactions with the insurance company will support follow-up discussions and serve as a reference for resolving disputes. By approaching the process with preparation and communication, policyholders can efficiently manage their claims and enhance their experience with customer service.

The Impact of Credit Scores on Car Insurance

A significant number of insurance companies in the United States utilize credit scores as a determining factor in calculating car insurance premiums. The reasoning behind this practice is that individuals with higher credit scores are often perceived as lower-risk clients. This correlation arises from the belief that credit history can provide insights into a person’s financial responsibility and likelihood to file claims. Accordingly, states like California, Massachusetts, and Hawaii are notable exceptions where the use of credit scores in determining car insurance rates is prohibited.

Insurers often analyze various elements of a person’s credit report, including payment history, outstanding debts, credit age, types of credit accounts, and recent inquiries. A positive credit score typically indicates timely payments and a low debt-to-income ratio, which can translate to lower insurance premiums. Conversely, a poor credit score may lead to higher premiums due to the perceived risk associated with insuring individuals who have demonstrated financial instability.

To potentially mitigate higher car insurance costs linked to credit scores, individuals can take proactive steps to improve their credit ratings. Regularly checking one’s credit report for errors or discrepancies ensures that inaccuracies do not negatively impact the score. Paying bills on time and maintaining low credit card balances are also crucial. Additionally, steering clear of unnecessary credit inquiries, such as applying for multiple credit cards within a short period, can help maintain a stable credit score.

While credit scores play a significant role in car insurance pricing, it is also important for drivers to shop around and compare quotes from different insurers. This practice may reveal more favorable rates, regardless of credit history. Consequently, consumers are encouraged to understand how their credit profiles impact car insurance costs, and take necessary steps to strengthen their creditworthiness.

Future Trends in Car Insurance

The car insurance landscape is rapidly evolving, influenced by advancements in technology and shifts in consumer preferences. One of the most significant trends is the emergence of autonomous vehicles, which have the potential to reshape not only driving norms but also the car insurance market. As these self-driving cars become more prevalent, traditional liability models may be challenged. Insurers may need to consider who is liable in the event of an accident involving an autonomous vehicle, leading to new insurance products specifically geared for this technology.

Another transformative trend is the rise of telematics-based insurance, also known as usage-based insurance (UBI). This approach utilizes devices installed in vehicles to monitor driving behavior, such as speed, acceleration, and braking patterns. Insurers can offer personalized premiums based on individual driving habits, promoting safer driving practices. The potential for reduced premiums based on responsible behavior could be appealing for many consumers, offering them more control over their insurance costs.

Additionally, the integration of technology within the claims process is revolutionizing how consumers interact with insurance providers. The use of mobile apps and online platforms allows policyholders to report claims, upload photos of damages, and communicate with claims adjusters seamlessly. This shift not only speeds up the claims process but also streamlines communication, making it more transparent and efficient. As technology continues to evolve, insurance companies are likely to invest in artificial intelligence and machine learning to enhance fraud detection and improve customer service.

These trends signify a significant shift in the car insurance industry, aligning it more closely with technological advancements and consumer needs. Staying abreast of these changes will be crucial for consumers as they adapt to the evolving landscape of car insurance in the United States.

Conclusion

Car insurance is a vital component of responsible vehicle ownership, offering protection against potential financial losses from accidents, theft, or damage. Understanding the various types of coverage—such as liability, collision, and comprehensive—can help you choose a policy that fits your needs and budget. It’s essential to regularly review your coverage and compare options from different providers to ensure you’re getting the best deal.

If you have any questions or concerns about our Article, please reach out to our support team. We’re here to help you!

Very useful for people

good

You really make it seem so easy with your presentation but I find this topic to be actually something which I think I would never understand. It seems too complex and very broad for me. I’m looking forward for your next post, I’ll try to get the hang of it!

seo просування ціна

I have been browsing online more than three hours today,

yet I never found any interesting article like yours.

It is pretty worth enough for me. In my opinion, if all webmasters and bloggers

made good content as you did, the web will be a lot more useful than ever before.

Very good post! We will be linking to this great post on our site.

Keep up the great writing.

Excellent blog right here! Also your website a lot up fast!

What host are you the usage of? Can I am getting

your associate hyperlink to your host? I want my web site loaded up as quickly as yours

lol

Hi i am kavin, its my first time to commenting anywhere, when i read this paragraph i

thought i could also make comment due to this sensible paragraph.

Useful information. Fortunate me I found your site accidentally, and I’m stunned why this coincidence didn’t happened earlier! I bookmarked it.

Interesting blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple adjustements would really make my blog shine. Please let me know where you got your theme. Appreciate it